HODL is one of the most popular tactics used to buy cryptocurrencies because it is simple and has been used since crypto began. Today, Crypto users are rising globally to all times new highs. But not all users are familiarized with the details of this new digital economy and how it works.

With the global expansion and adaptation of cryptocurrencies, an abundance of services and information has risen. Navigating this ocean of apps, wallets, strategies and market mixed info can be challenging and turn some users off. However, if users can identify the correct information and stay away from shady sites and scams, there is much to benefit from in this new digital economy.

HODL is the most popular crypto strategy for stable coins and volatile coins like Bitcoin, Ethereum, Dogecoin, etc. The term HODL, used by crypto traders, is said to have originated by a misspelling of “HOLD.” The term quickly went viral in trading forums and stuck. Some say the term also means “Hold On for Dear Life.” Either way, the term is used to describe a straightforward strategy. Always buy and never sell crypto, whether the price is up or down.

Believe Crypto Is The Future? Then Buy And Hold Until The Future Gets Here

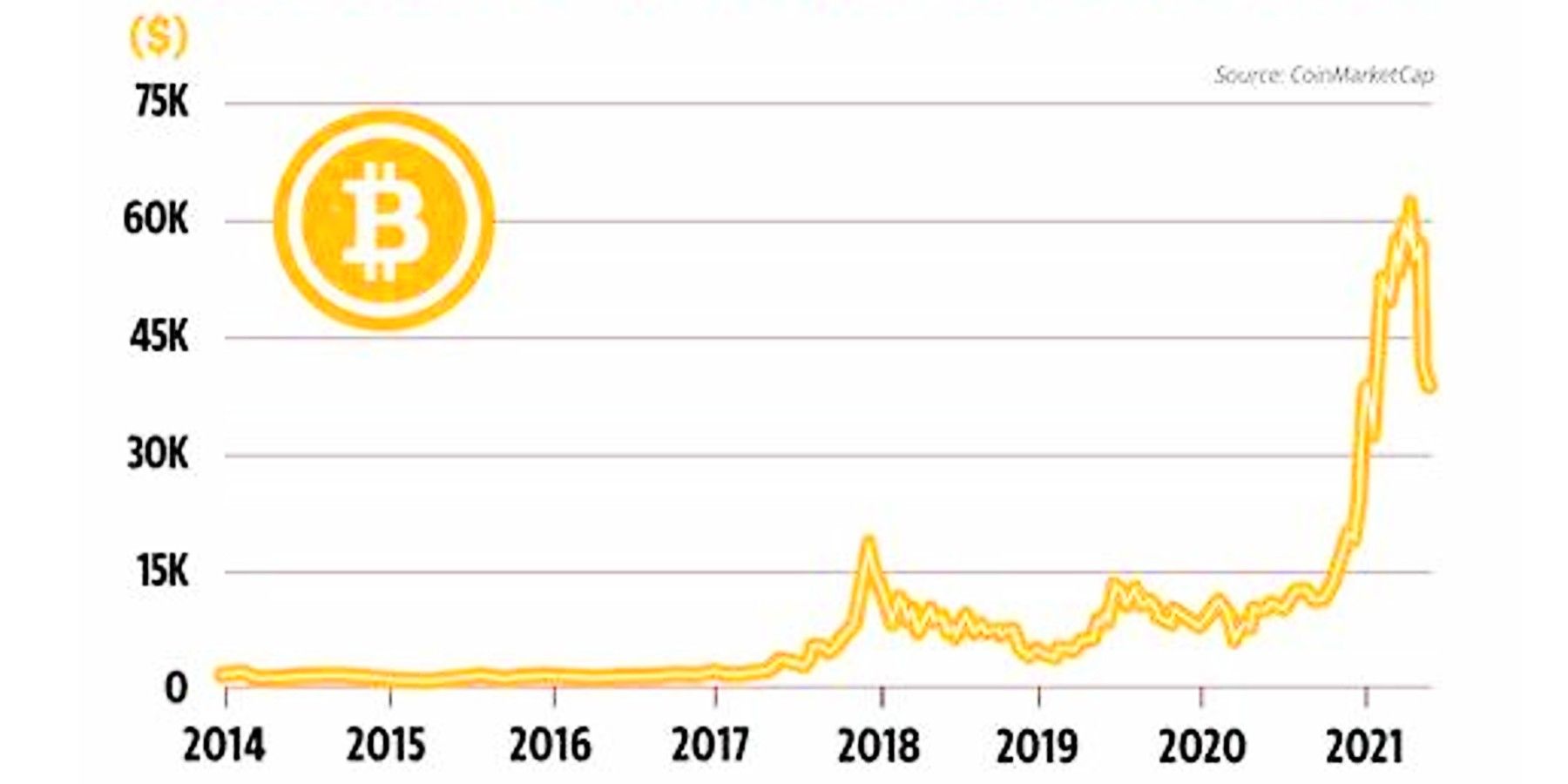

To always buy and never sell, even when the price of crypto is dropping, does not seem to be a good investment. However, HODL is one of the most successful investment strategies. Why? Because users are not buying to sell in the short term where margin profits are low and risks are high. They are buying to save and make a long-term gain. If someone would look at a volatile cryptocurrency like Bitcoin, they might see that the price goes up and down erratically in a period of one or three months. However, if they look at the historical chart of Bitcoin since it was created, they will see one thing, it has been climbing steadily.

Short-term operations seeking to profit from short time ups and downs are risky because cryptos are unpredictable. Long-term investment also has a risk, but investors cannot ignore the upward tendency. If they had bought 500 USD worth of Bitcoin in 2011, today they would have between 3.7 and over four million dollars, depending on the specific date of purchase and the transaction. But 11 years is a long time to hold on to crypto. HODL strategies usually go for one year period.

The days of becoming a millionaire for holding on to a couple of Bitcoins bought cheaply are over. However, HODL is still the most effective long-term strategy and can be profitable. It all comes down to one question: “Do you believe in the long-term performance of cryptos?” If the person thinks that the future of money is digital and envisions the world embracing cryptocurrencies, then they should buy and hold. It takes nerves of steel not to sell cryptocurrencies when the market is crashing. Experts suggest that if they are in the game for the long run, it is best not to constantly check on prices daily. As a safety and risk rule, investing in volatiles should never exceed five to 10 percent of an investor's portfolio.

Source: Investopedia