The Google Pay app has been redesigned and reimagined to make transactions simpler and more secure, as well as gaining some new features. More people are relying on their smartphones to complete tasks, including online payments, and Google is positioning its Pay app to become the default money-managing app for users. The latest changes offer more features than the competition, including Apple Pay and Samsung Pay.

Originally released as Android Pay in 2015, Google merged Android Pay with Google Wallet into one service in 2018, renaming it Google Pay in the process. The payment platform is available on both Android and iOS devices and Google states that more than 150 million people in 30 countries are using the service every month.

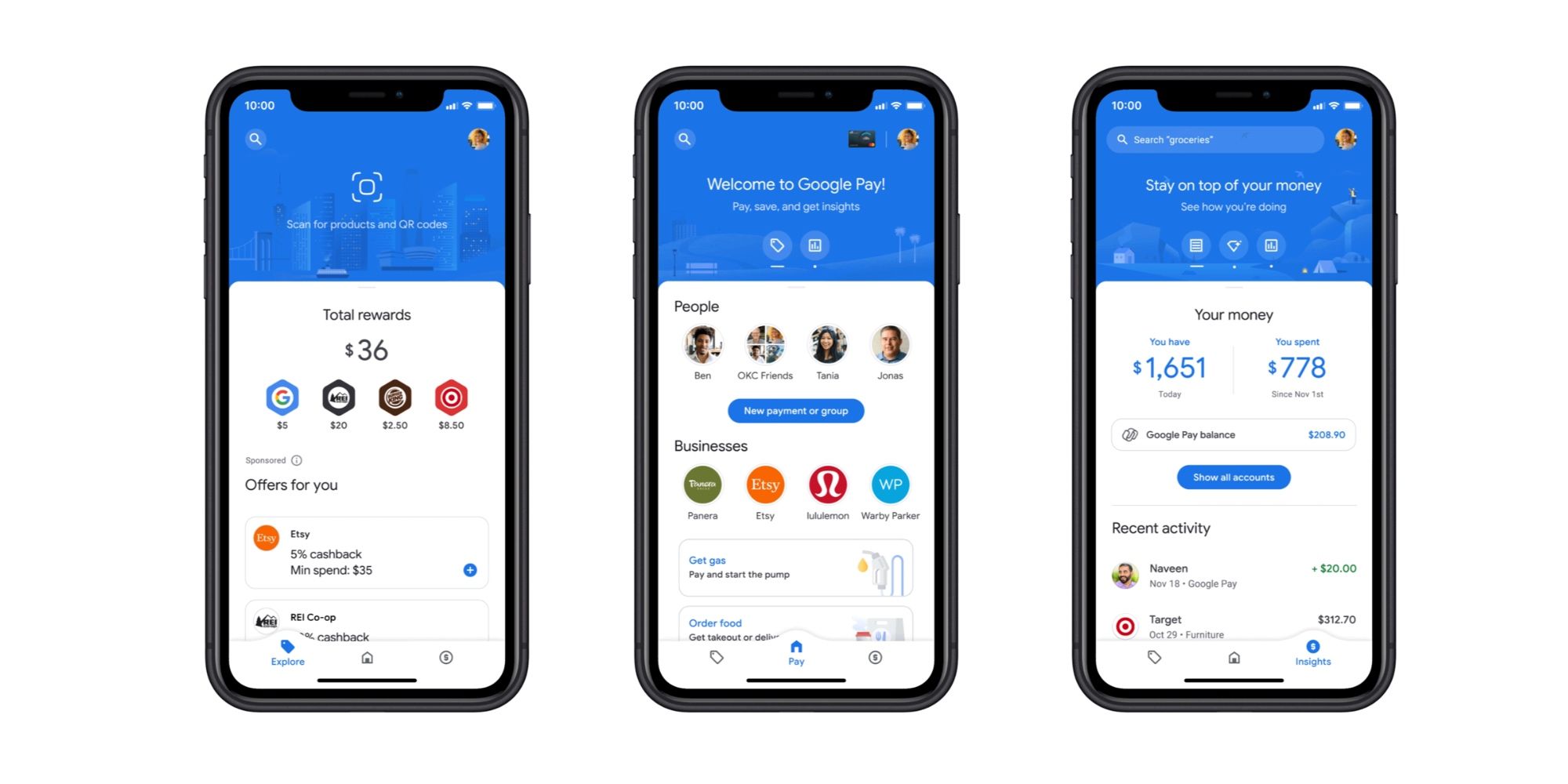

The redesigned Google Pay app is more than a mobile payment solution as the focus has shifted to building financial relationships with friends and businesses. This is in addition to providing those who connect their bank account or cards with a clearer view of periodic spending summaries, trends, and insights. Essentially, Google explained that it has now turned Google Pay into a one-stop money-management app. For example, it can now be helpful in situations where users need to split expenses, such as restaurant outings or rent with others. The built-in group feature allows members to keep track of who owes what, and the app automatically splits the bill, accordingly. Google Pay can also help users save money, as the app finds the latest offers and coupons from popular brands, including Burger King, Target, and Etsy. Users can activate offers and coupons with a tap, and have them automatically applied in-store or online. In addition, Google Pay also lets users order food, pay for gas, or for parking.

Security, Banking, & Even More Features

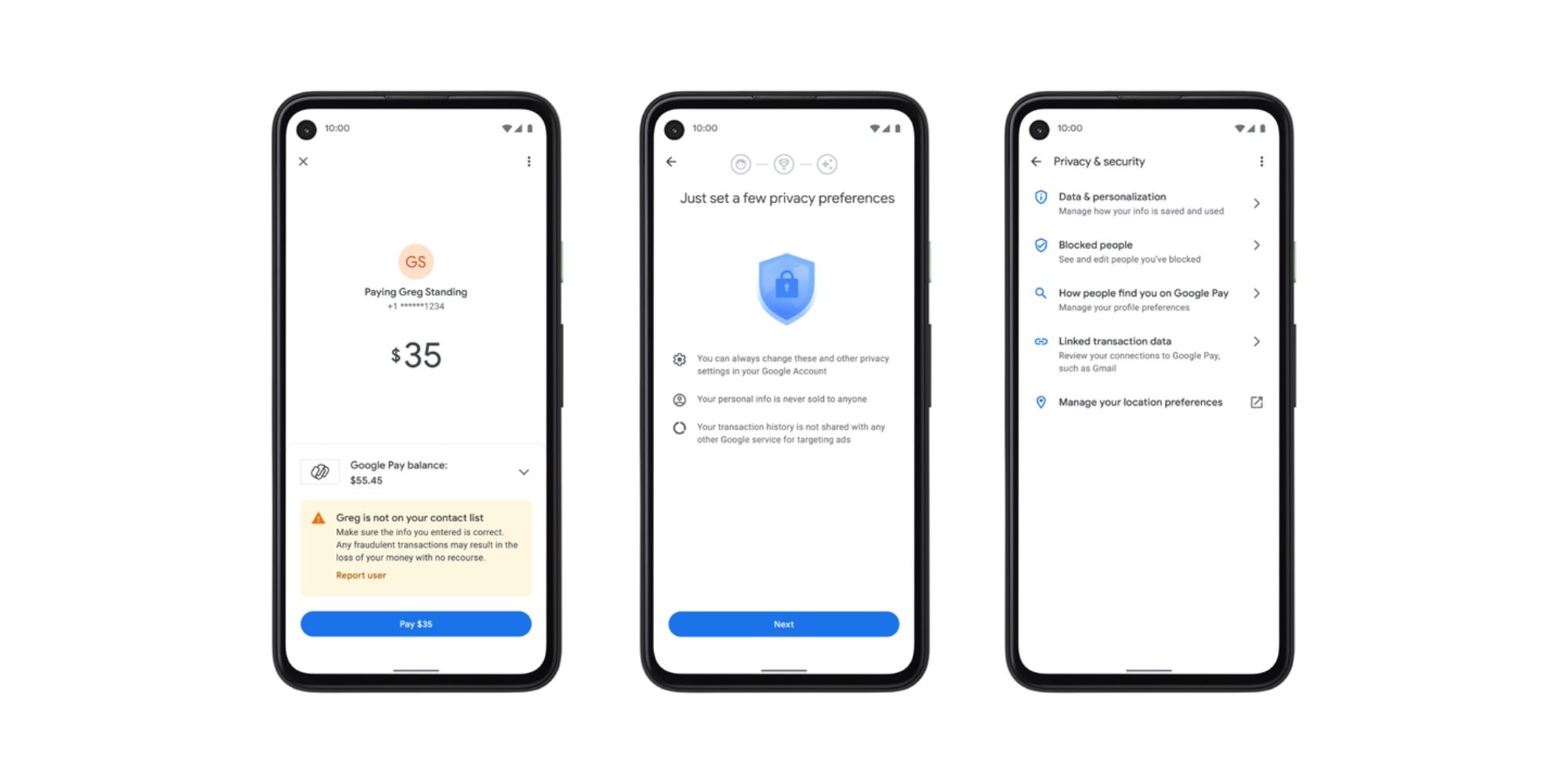

The new features mean greater security risks for Google Pay users, which is why Google says it will never sell private information to third parties or share transaction history with other Google services for targeted ads. The Google Pay app will also alert users during risky transactions and lets them control their privacy settings, which can be changed at any time. In fact, the setting which lets Google Pay access the user's transaction history to create a personalized experience is turned off by default. This setting can be turned on permanently or set to three months. After which, users can decide whether to keep it on or turn it off again.

Google Pay also plans to create a digital bank account called Plex, offering checking and savings accounts with no monthly fees, overdraft charges, or minimum balance requirements. Plex is due to become available at some point in 2021 and will initially be limited to eleven banks and credit unions in the U.S.. For those interested in this mobile-first banking feature, Google is now allowing users to join a waitlist within the new Google Pay app that's rolling out now, and available to download from Google Play or the App Store.

Source: Google