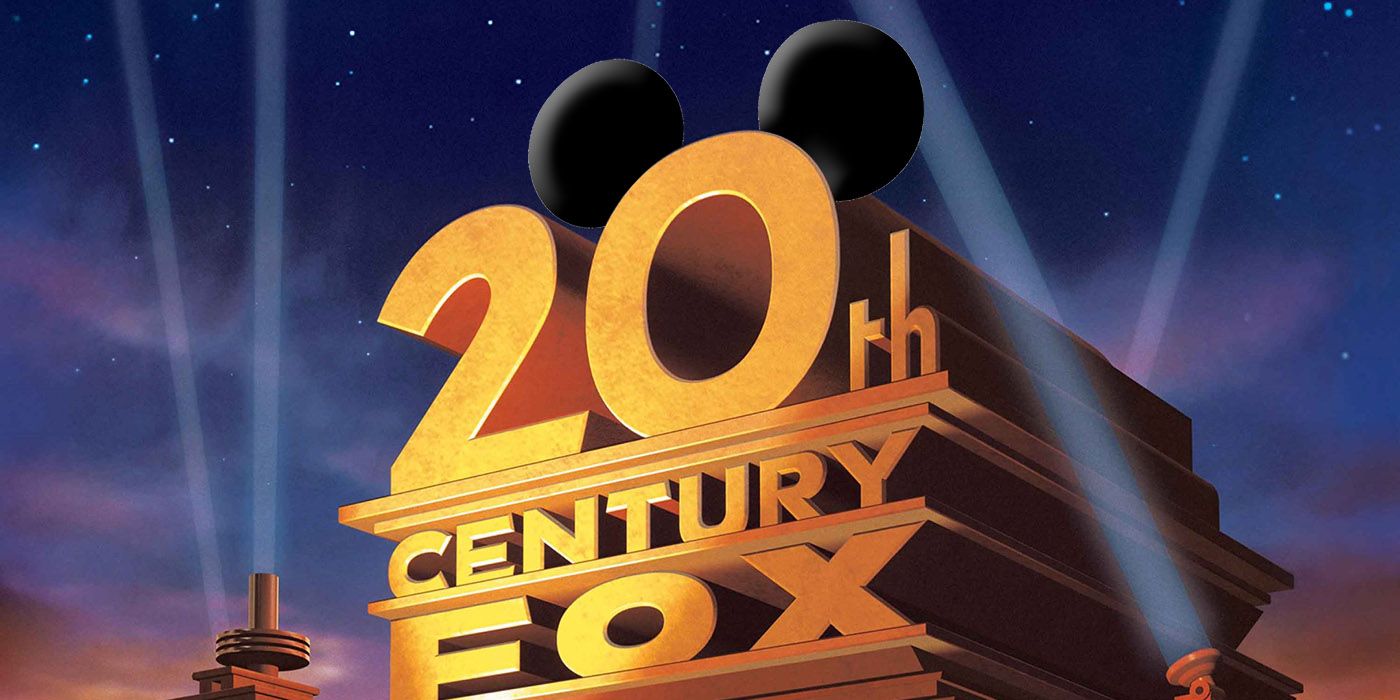

Comcast may buy 21st Century Fox instead of Disney, but what does this mean - and is either outcome actually good for audiences? For several months now, it's been all but accepted that The Walt Disney Company will acquire various assets from 21st Century Fox. This deal would give Disney, already one of the most powerful media companies on the planet, the rights to various valuable intellectual properties and channels. Combined, Disney and Fox account for over 40% of the domestic box office. By purchasing most of their film and TV outlets including channels like Fox Sports and FX, and franchises like the X-Men and Avatar movies Disney would become arguably the dominant force in American and international media.

Much has been made of this proposed deal, which would set back Disney $52.4bn. If Disney were to acquire networks like FX, stakes in National Geographic, Hulu, Sky, and various international satellite groups, it would give them a level of power that is near unprecedented, even in today's age of growing media monopolies.

Related: How Disney Buying Fox Could Affect the Avatar Sequels

However, that deal may soon be off the table, as Comcast has started a bidding war not only for the acquisition of the Britain based satellite group Sky, but reportedly began discussions to find a way to beat Disney to the punch in acquiring Fox. Comcast already made media history in 2009 when they acquired a majority stake in NBCUniversal. They owned 51% of the company until March 2013, when minority shareholder General Electric gave them the remaining stake. Getting control of 21st Century Fox would make Comcast the biggest player in Hollywood, even more so than the mighty Disney.

Nothing has gone through yet and deals like this can take months or even years to get finalized. For now, what we have are two striking possibilities, assuming one of the companies manages to get a deal closed. Either Disney buys Fox or Comcast does. At this point in time, the deal could fall through for both sides, but given what is at stake, it seems highly unlikely.

- This Page: The Disney/Fox Deal So Far

What Disney Buying Fox Would Mean

Disney buying Fox is the deal that seems to make the most thematic sense. Given Disney's control over some of the most profitable franchises in modern Hollywood, it's a somewhat sensible suggestion that they would want to complete the set, as it were. Buying Fox's assets would give them control over the remaining Marvel properties they don't yet possess, notably Deadpool, X-Men and Fantastic Four. Minor Marvel efforts like FX's Legion would also come under their sizable umbrella, as would the Avatar franchise (which already has pride of place in Disney thanks to its inclusion as a theme park attraction in Animal Kingdom).

The problem with this is that the chances are we won't see more movies as a result of such a deal. Disney would have less to gain from further competition, even from themselves, so the number of films released every year would probably go down. Why put, say, the new Alien film on the release calendar next to the new Marvel film when both movies are aiming at similar demographics and the money is going to the same place? Ryan Murphy signed an exclusive deal with Netflix in February and cited the possible Fox-Disney deal as one of the reasons for his departure from Fox, where he had hit shows such as Glee and American Horror Story. Murphy noted that his creative freedom could be limited under such a restrictive deal.

RELATED: How Long Until X-Men Join Spider-Man and the Avengers?

A Fox acquisition would also give Disney further control of the streaming market. They currently have 30% shares ownership of Hulu, and the deal would give them majority rule with 60%. Given the company's recent announcements of a Disney exclusive streaming service, it seems possible that such a deal would allow them to combine Hulu with their upcoming platform. While little has been revealed about Disney's plans for their streaming platform we know there will be a Star Wars series and original Disney movies exclusive to the service it would be beneficial for such an endeavor to have a sizable back-catalog of fan faves ready to go on launch day. It would certainly make them a true competitor with Netflix.

The fears go beyond the standard monopoly concerns. Last November, Disney banned the Los Angeles Times from attending press screenings in retaliation for the paper's coverage of the company's political influence in Anaheim. Eventually, the company reversed that decision after protests and threats of boycott from other publications. However, for many journalists, the prospect of Disney having further power to exact this kind of anti-press mentality is downright chilling. If they end up holding that much force in the industry - with over 40% of the media under their thumb - then what is to stop them from banning journalists from press screenings or events simply because they didn't like a critical piece they wrote?

Disney also exerts immense control over movie theaters when it comes to the releases of their films. For the release of Star Wars: The Last Jedi, Disney demanded a 65% cut of the domestic sales (the typical deal is 55 - 60%) and forced theaters to a four-week hold in each venue. Those who broke that contract would face penalties and have the film removed from their screens. Some indie theater owners have already opposed this move, choosing not to run the films simply because they can't afford to. A Fox acquisition would give Disney further power to push through this oppressively strict level of market control.

What Comcast Buying Fox Would Mean

Reports suggest that Comcast could outbid Disney for Fox with a hefty offer of $60bn. And while it shifts power from Disney, a deal between Fox and Comcast would not be free of such controversies or issues. They are the largest broadcasting and cable TV company in the world, and the second largest pay-TV company after AT&T (who are currently in the process of being acquired by Time Warner, assuming the Department of Justice's lawsuit preventing it fails). On top of that, Comcast are the largest internet provider in America.

Related: Why Did Fox Sell to Disney?

Media-wise, they're just as big. Crucially, they own NBCUniversal, meaning they already own one of Hollywood's major players; while they don't own the major titles like Disney does, Universal is not without its billion-dollar-blockbusters, such as the Fast and Furious series. They also own networks such as NBC, USA, and E!, and in 2016, they acquired Dreamworks Animation for over $3.8bn. There has also been talk of the company acquiring the entertainment company Lionsgate, whose subsidiaries include the cable network Starz and who own properties like The Hunger Games and Twilight. Comcast also currently own a minority stake in Hulu, which a Fox bid would give them majority control over. Even if they fail in their bid and Disney wins, they could make it very hard for their competitor to take total control of Hulu.

Where Comcast has an extra card to play over Disney is in their power as an internet provider, something Disney has no stakes in. The Fox deal would give the winner more shares in Sky (who they're looking to gain control in to leverage the deal), who are an internet provider in the UK. As the largest cable TV company on the planet, Comcast would only stand to gain more from such an acquisition: their market control would go from the biggest to near indestructible, and the lack of competition would affect paying customers. If there's only one game in town, how do you fight for the best deal? What stops them from setting the prices sky high and forcing everyone to pay up? As net neutrality falls further under risk, Comcast's growing might in the market would make it tougher for users to fight for an accessible and neutral internet.

-

The best bets on what will happen in the future are on Disney winning the deal, pending regulatory approval. They stand to gain the most from such a deal and are putting up the biggest fight to get what they want. As history has proven, it is a foolish folly to bet against Disney.

Still, neither option is especially appealing to critics and audiences. Whatever happens, a multi-billion dollar corporation with an already vast grasp of the international media market will own even more of it by the time the decade is over.