Apple Card users will soon be able to deposit their daily cash into a high-yield savings account from Goldman Sachs, but how exactly does that work? It's a new way to earn cashback from Apple, making the Apple Card even more appealing to potential customers. The Apple Card is a credit card unlike most from the banking industry centered around transparency and integration with Apple's iPhone. There are no fees on the Apple Card, and potential interest charges are shown clearly within the Apple Wallet app. Most importantly, Apple offers competitive cashback options through the Apple Card that can be utilized everywhere that accepts MasterCard.

The appeal of the Apple Card is the limited fees and enticing cashback options that are widely accepted. Apple offers two percent cashback on every purchase made using Apple Pay on the company's devices and provides one percent cashback on purchases made using the physical titanium card. Every purchase made at Apple earns three percent cashback, the highest possible earnings year-round. Other stores provide three percent cash back all year, including Ace Hardware, Duane Reade, Walgreens, Exxon, Nike, Uber, T-Mobile, Mobil Panera Bread, and Walgreens. In addition, Apple routinely adds boosted cashback deals at select retailers that allow users to earn the most daily cash for a limited time. Users can deposit all of this daily cash into a savings account.

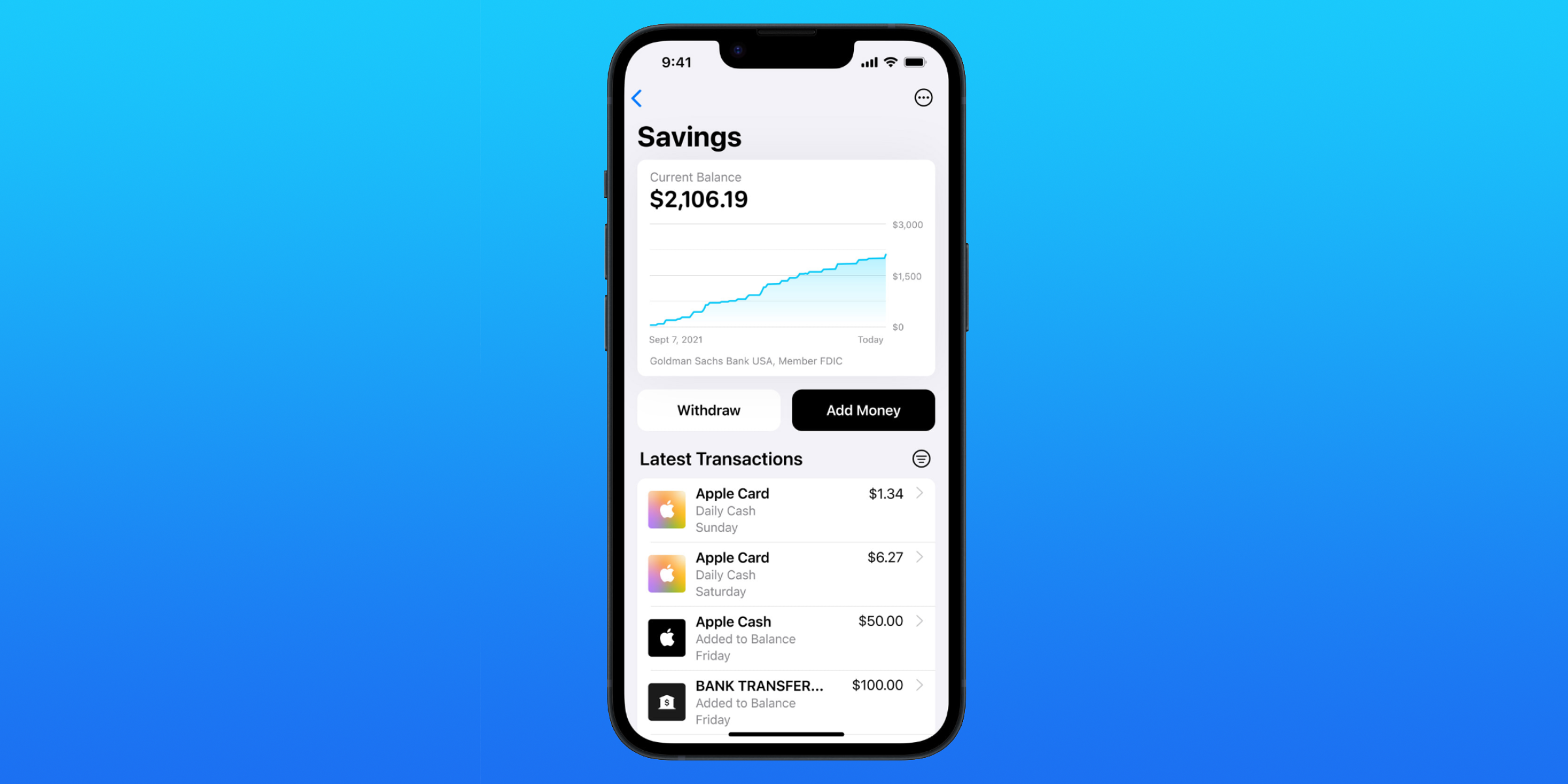

By default, when a user qualifies for the Apple Card, they will be prompted to set up an Apple Cash Card. This essentially functions as a virtual debit card, and people can load it with money directly from a bank account. Apple Card users earn daily cash with every purchase, and this daily cash is deposited into the Apple Cash Card. From there, it can be spent anywhere Apple Pay is accepted, sent through iMessage, or deposited to a bank account. However, Apple's new savings account option can deposit directly into a bank account with accrued interest.

Earn Interest On Apple Daily Cashback

When the new option debuts "soon" — Apple did not provide an exact date of when the feature would launch — Apple Card users can quickly open a high-yield savings account through Goldman Sachs. Again, the company did not provide concrete details on the interest rates for the new savings account, only noting that they are "high-yield." Nonetheless, it will allow users to earn interest on their daily cash earned through the use of the Apple Card. Users can also withdraw the money in this savings account to a linked bank account or the Apple Cash Card.

The latest Apple Card benefit makes the company's credit card even more appealing. Apple's competitive cashback offers are already appealing to users, who can rest easy knowing that they will earn daily cash on every Apple Card purchase. With a connected savings account through Goldman Sachs, users can earn interest on their daily cash and have a reason to save it. More details are needed to see just how great of a benefit this is, but it sure looks like a no-brainer for Apple Card users when it debuts.

Source: Apple